hotel tax calculator bc

The Hospitality Management Calculator has a collection of equations used for hotel and restaurant management. 8 rows Alberta tax rates British Columbia tax bracket British Columbia tax rates Yukon tax bracket Yukon tax rates Northwest Territories tax bracket Northwest Territories tax rates.

Premium Photo Business Accounting In Office Concept

Beds cots cribs linens and pets but not including the goods and services tax GST.

. That means that your net pay will be 40568 per year or 3381 per month. Amount without sales taxes x PST rate100 Amount of PST in BC. For this calculator rent is the act of paying a landlord for the use of a residential property.

For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest. Ad Finding hotel tax by state then manually filing is time consuming. Used as a noun it can also refer to the actual payment for the temporary use of a residential property.

Municipal Occupancy Tax List. Please enter your income deductions gains dividends and taxes paid to get a summary of your results. Your hotel is located in Victoria which is subject to a 3 MRDT and you provide a room in your.

For a list of municipalities that have enacted this. Formula for calculating GST and PST in BC. 55 billion GST rebates to help who lost income due to COVID-19.

These calculations are approximate and include the following non. 3 State levied lodging tax varies. Avalara automates lodging sales and use tax compliance for your hospitality business.

Find out about the rates rebates in BC. To calculate the subtotal amount and sales taxes from a total. The state hotel occupancy tax rate is 6.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This is income tax calculator for British Columbia. 56 1 An operator must keep books of account records and other documents sufficient to provide the director with the necessary particulars of the following.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. Relief measures for individuals and businesses by Revenu Québec. Ad Finding hotel tax by state then manually filing is time consuming.

Calculate the GST 5 PST 7 amounts in BC by putting either the after tax or before tax amount. Charge and collect PST at the time the tax is payable unless a specific exemption applies Report and pay the PST you collect and the PST you may owe on items you use in your. Impose a municipal tax on occupancies in that municipality which can be less than or equal to 3.

Some communities such as Downtown Victoria have an. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160. Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below.

Avalara automates lodging sales and use tax compliance for your hospitality business. Amount without sales taxes x GST rate100 Amount of GST in BC. Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax.

A a sale of.

Business Deductions For The Self Employed 12 Overlooked Tax Deduction Tips

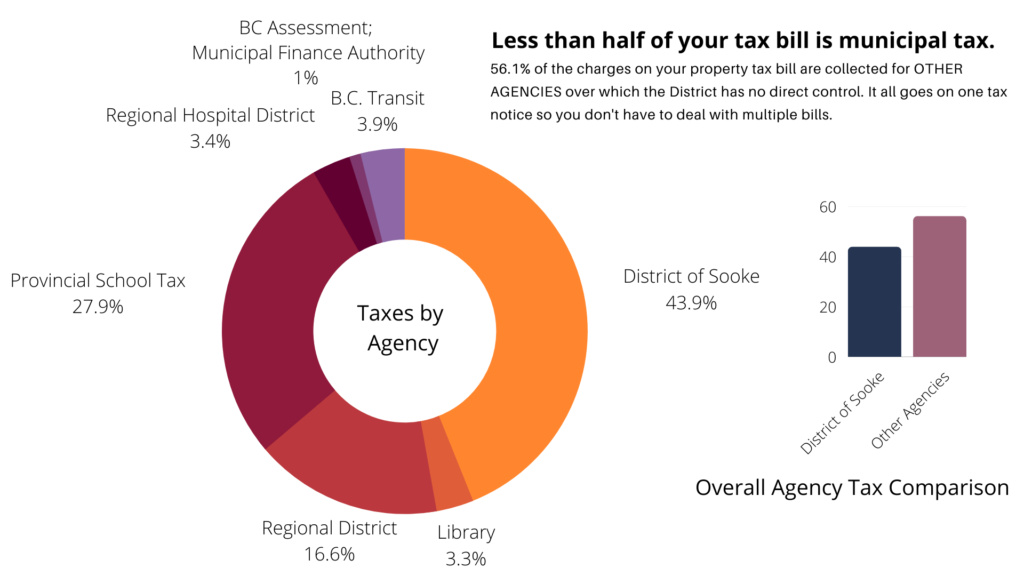

British Columbia Property Tax Rates Calculator Wowa Ca

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

This Tropical Pool House Has A Swim Up Bar And A Glass Enclosed Dining Area

Vancouver Tax Accountant Surrey Accountant Burnaby Accountant

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

St Kitts And Nevis Taxes Property Income Corporate Tax Rates

Tax Comparisons Around The World Movehub

![]()

Set Of Color Flat Design Icons By Creative Graphics On Creativework247 Flat Design Icons Icon Design Web Design Icon

Download Accounting Flat Banners For Free Accounting Vector Free Goods And Services

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Verify Property Mcd Approved Dda Approved Govt Approved Property Documents Required For Home Loan Property Exhibition Property Vneshnij Vid Doma Dom Vid

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips